3 min read

TAKE A BREAK

Bitcoin Crash Warning: Why BTC Could Drop Below $70K and Erase U.S. Election Gains

Updated: 2/25/2025

Adding to concerns, U.S.-based spot Bitcoin ETFs have recorded five consecutive days of net outflows, signaling a potential loss of institutional confidence in BTC. With market conditions shifting, analysts are examining on-chain data and technical indicators to predict the next major Bitcoin move.

Rising Bitcoin Supply on Exchanges and Whale Sell-Offs

Bitcoin recently hit an all-time high above $109,000 before reversing course. Key market forces, including institutional outflows, U.S. macroeconomic conditions, and increased BTC supply on exchanges, have contributed to its decline.

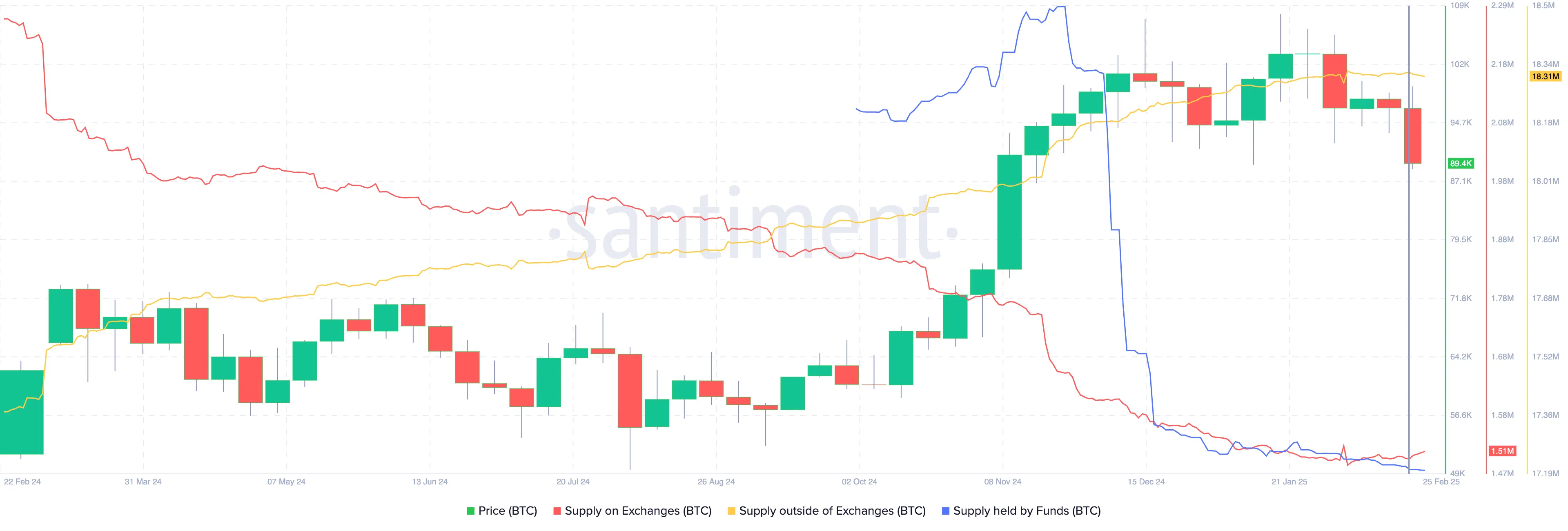

According to on-chain data from Santiment, the supply of Bitcoin on exchanges is rising, while whale wallets are offloading BTC. This shift suggests that major investors are moving their holdings from private wallets to exchanges, a common prelude to increased selling pressure.

A decline in Bitcoin held by funds further reinforces bearish sentiment. Data from Farside Investors shows that spot Bitcoin funds are experiencing net outflows, a red flag for future price movement.

Institutional Investors Are Pulling Back

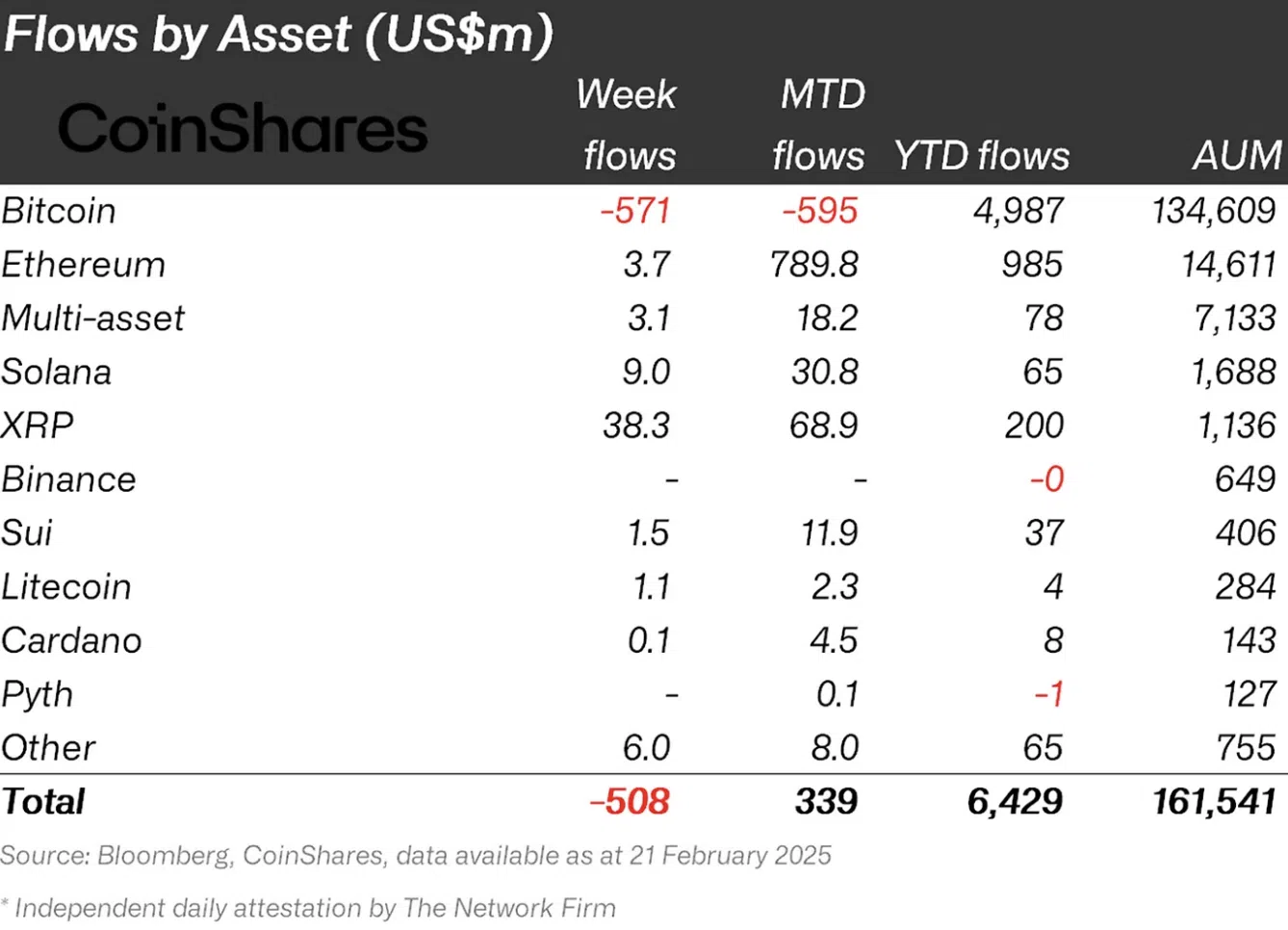

Data from CoinShares confirms a significant capital outflow from Bitcoin funds:

- $595 million in BTC outflows month-to-date.

- $571 million in outflows in the past week alone.

- Meanwhile, Ethereum, Solana, XRP, and multi-asset funds are seeing inflows.

These figures indicate a shifting preference among institutional investors, who may be diversifying into alternative crypto assets while reducing exposure to Bitcoin.

Adding to the bearish sentiment, MicroStrategy (MSTR) stock has taken a hit as investors question its high valuation relative to its Bitcoin holdings. Analysts at 10x Research believe that MSTR was overvalued by nearly 60%, leading to a significant sell-off.

Whales Are Selling Bitcoin

Whale activity has played a crucial role in Bitcoin’s recent price swings. Santiment’s on-chain data reveals:

- A decline in whale transactions valued at $100,000 or more.

- A similar drop in transactions above $1 million.

- An increase in profit-taking activity, further increasing sell pressure.

Consistent whale profit-taking can contribute to price declines, as large holders liquidate their positions before a deeper correction occurs.

Key Support Levels and the Next Big Bitcoin Trade

Bitcoin recently fell below the $90,000 level, triggering a technical reassessment. According to crypto analysts, BTC’s next major support zones are:

- $85,072 (S1)

- $81,500 (S2)

- $76,900 (S3)

If Bitcoin breaks below these levels, the next critical support is $70,577—its pre-election price level. Should that support fail, BTC may test liquidity at $67,476, increasing the risk of a deeper correction.

However, bullish factors remain in play. Bitcoin is still 12% below its $100,000 milestone, and renewed buying pressure or favorable macroeconomic developments could spark a reversal rally.