3 min read

TAKE A BREAK

Chainlink price rises as Trump’s WLFI buys, potential Cardano partnership

Updated: 1/20/2025

WLFI’s Strategic Chainlink Purchases

World Liberty Financial bolsters its LINK holdings.

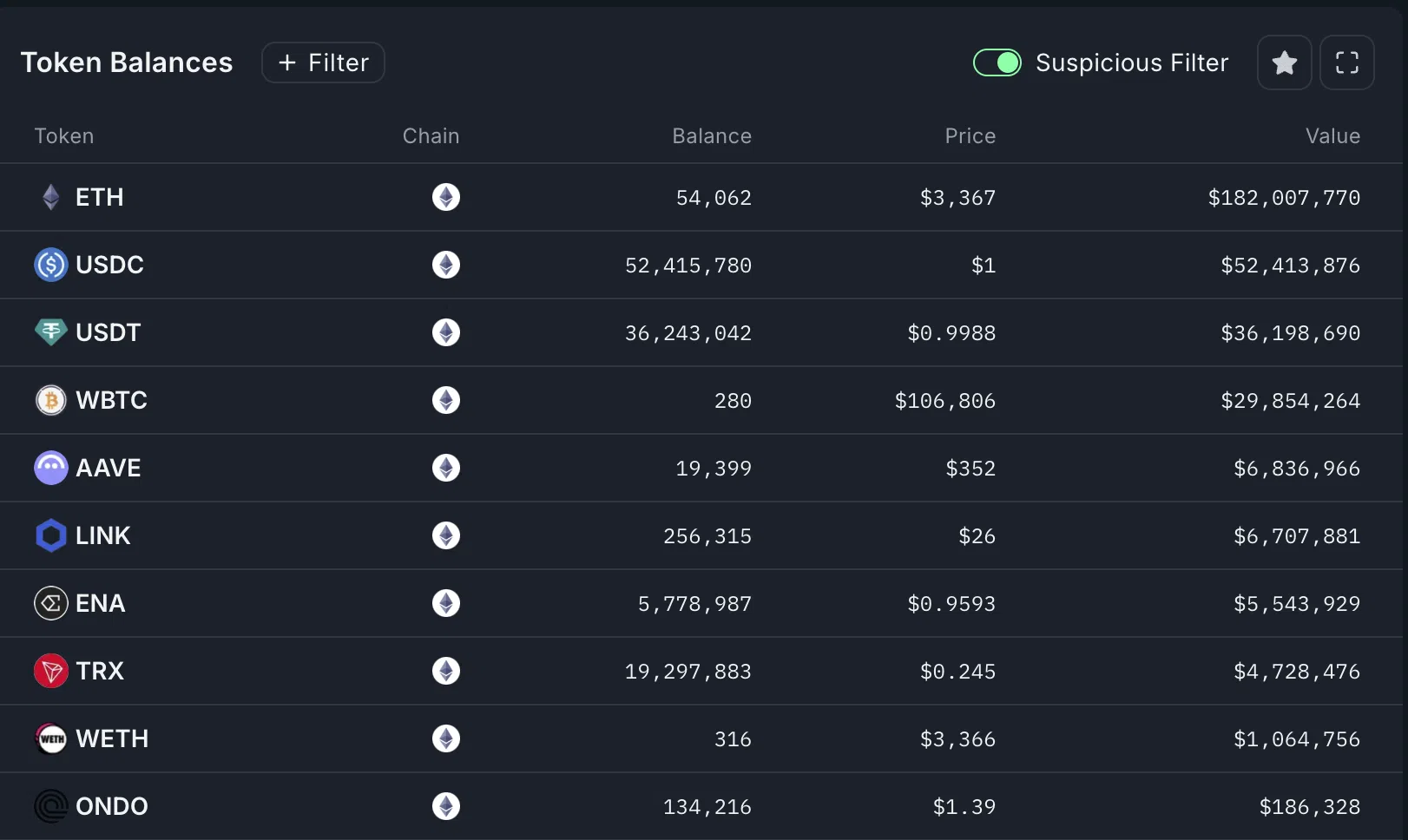

Nansen data reveals that WLFI recently acquired an additional $4.6 million worth of Chainlink tokens, bringing its total LINK holdings to over $6.6 million. This purchase comes as part of WLFI’s diversified crypto portfolio, which includes Ethereum, Tether, Wrapped Bitcoin, and other assets valued at $322 million.

With Trump’s administration taking a pro-crypto stance and establishing a crypto advisory council, regulatory developments could positively impact Chainlink and other assets in WLFI’s portfolio.

Potential Cardano Partnership on the Horizon

Cardano’s founder hints at collaboration with Chainlink.

Charles Hoskinson, founder of Cardano, has confirmed plans to pursue partnerships in 2025, including discussions with Chainlink. A collaboration between Cardano and Chainlink could unlock new opportunities in decentralized finance (DeFi) and real-world asset tokenization, further enhancing LINK’s market appeal.

Declining Exchange Balances: A Bullish Signal

Supply decreases as more LINK tokens exit exchanges.

Data from Coinglass shows LINK exchange balances have fallen to their lowest levels since December 2024, signaling reduced selling pressure and increased demand. This trend supports the recent price rally, as reduced supply on exchanges typically correlates with upward price momentum.

Technical Analysis: Bullish Patterns Support Higher Targets

Chainlink’s chart points to continued gains.

LINK has broken above the critical resistance level of $22.87 and surpassed the upper boundaries of both a falling wedge and a bullish flag pattern—strong indicators of further upside. Additionally, the cup-and-handle pattern suggests a profit target of $37, calculated based on the depth of the cup.

Outlook for Chainlink

Riding the wave of institutional interest and strategic partnerships.

With increasing institutional interest, potential collaborations, and strong technical signals, Chainlink is well-positioned for continued growth. The combination of WLFI’s strategic purchases and Cardano’s partnership prospects solidifies LINK as a key player in the evolving DeFi and blockchain ecosystem.