3 min read

TAKE A BREAK

Is Ethereum Dead or Poised for a Comeback? A Deep Dive Into ETH’s Future

Updated: 2/12/2025

Ethereum Price Struggles Despite Bullish On-Chain Metrics

Key Highlights:

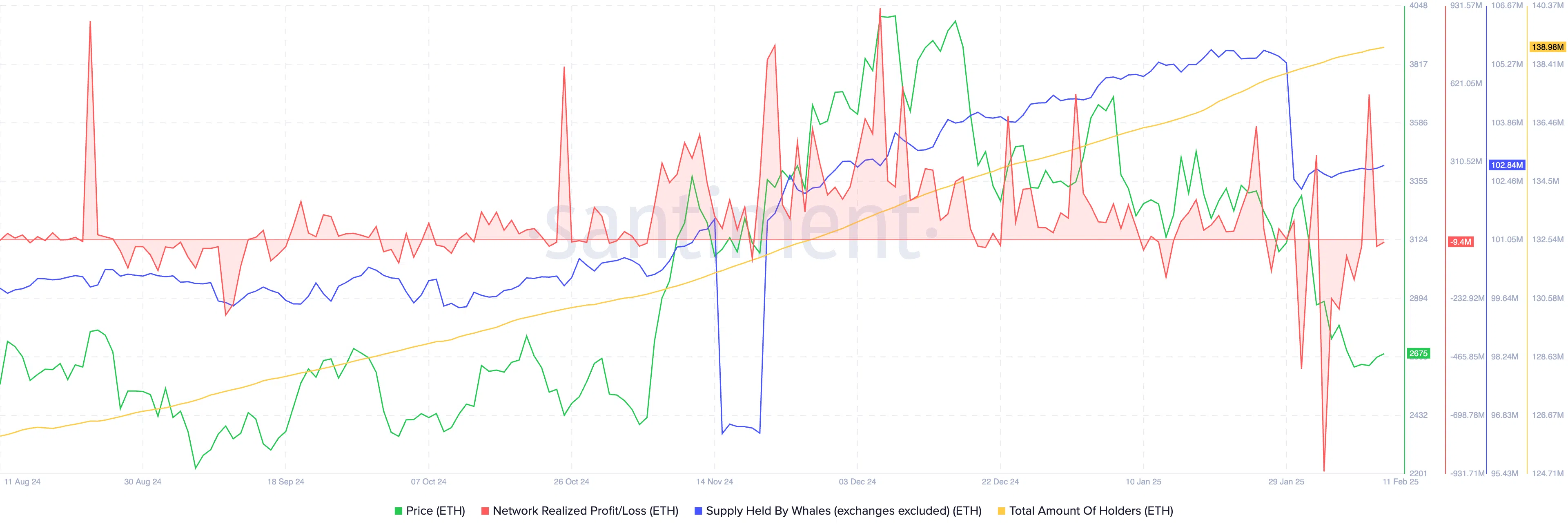

- Ethereum holder count surged to 138.98 million, adding nearly 500,000 new addresses in one week.

- Traders selling ETH at a loss could signal capitulation and potential price recovery.

- Derivatives market turning bullish, with open interest reaching $8.03 billion.

Ethereum’s price action has remained unimpressive, but on-chain data suggests growing network activity. The total number of ETH holders continues to rise, while derivatives traders are positioning themselves for a recovery. The increase in large negative profit/loss spikes indicates that many traders have exited at a loss—often a precursor to a market bottom.

Could Ethereum be setting the stage for a sharp rebound?

Whale Accumulation vs. Institutional Uncertainty

Key Insights:

- Whales are accumulating Ethereum, increasing their holdings by nearly 500,000 ETH in February 2025.

- Institutional interest in Ethereum ETFs remains uncertain, with recent $22.5 million outflows.

- Spot ETF inflows remain sluggish, while Bitcoin ETFs continue to dominate institutional investment.

While whales are accumulating ETH off exchanges, institutional investors appear hesitant. The lack of significant ETF inflows suggests that institutions remain undecided about Ethereum’s long-term prospects compared to Bitcoin.

Could Ethereum’s price remain suppressed if institutional demand doesn’t pick up?

Ethereum’s Strong Fundamentals: A Long-Term Bull Case

| Metric | Current Status | | --------------------------- | ---------------------------- | | Total ETH Holders | 138.98 million (record high) | | ETH Staked Percentage | 27% (down from 29%) | | Ethereum Open Interest | $8.03 billion (bullish) | | Institutional ETF Flows | Weak, with outflows recorded |

Ethereum’s fundamental value remains intact despite short-term struggles. The network is processing over $30 billion in daily transactions, largely powered by Layer 2 solutions like Arbitrum, Base, and zkSync.

With Ethereum’s DeFi and NFT dominance, is the market underestimating its long-term potential?

Bearish Pressure: Institutional Investors Shift Toward Bitcoin

Key Challenges Facing Ethereum:

- ETH staking has plateaued, dropping from 29% to 27% in recent months.

- Layer 2 chains are offering higher rewards, drawing liquidity away from ETH staking.

- Institutional investors favor Bitcoin, leaving Ethereum in a relative disadvantage.

Ethereum remains the backbone of the DeFi and NFT ecosystem, but competition from Layer 2 solutions and shifting investor sentiment towards Bitcoin ETFs have impacted its price trajectory.

Long-Term Outlook: Is Ethereum Ready for a Comeback?

Ruslan Lienkha, Chief of Markets at YouHodler, believes Ethereum is nearing a long-term accumulation phase, stating:

“Institutional investors see Ethereum approaching a strong support level, making it an attractive buy for long-term accumulation. Historically, this type of institutional entry has preceded market recoveries.”