3 min read

TAKE A BREAK

What is Polymarket? Exploring the hybrid prediction platform

Updated: 12/4/2024

Polymarket is a blockchain-based prediction market platform where users can trade shares tied to the outcomes of real-world events, leveraging transparency and decentralization to redefine speculative markets.

What is Polymarket?

A prediction market built on Polygon

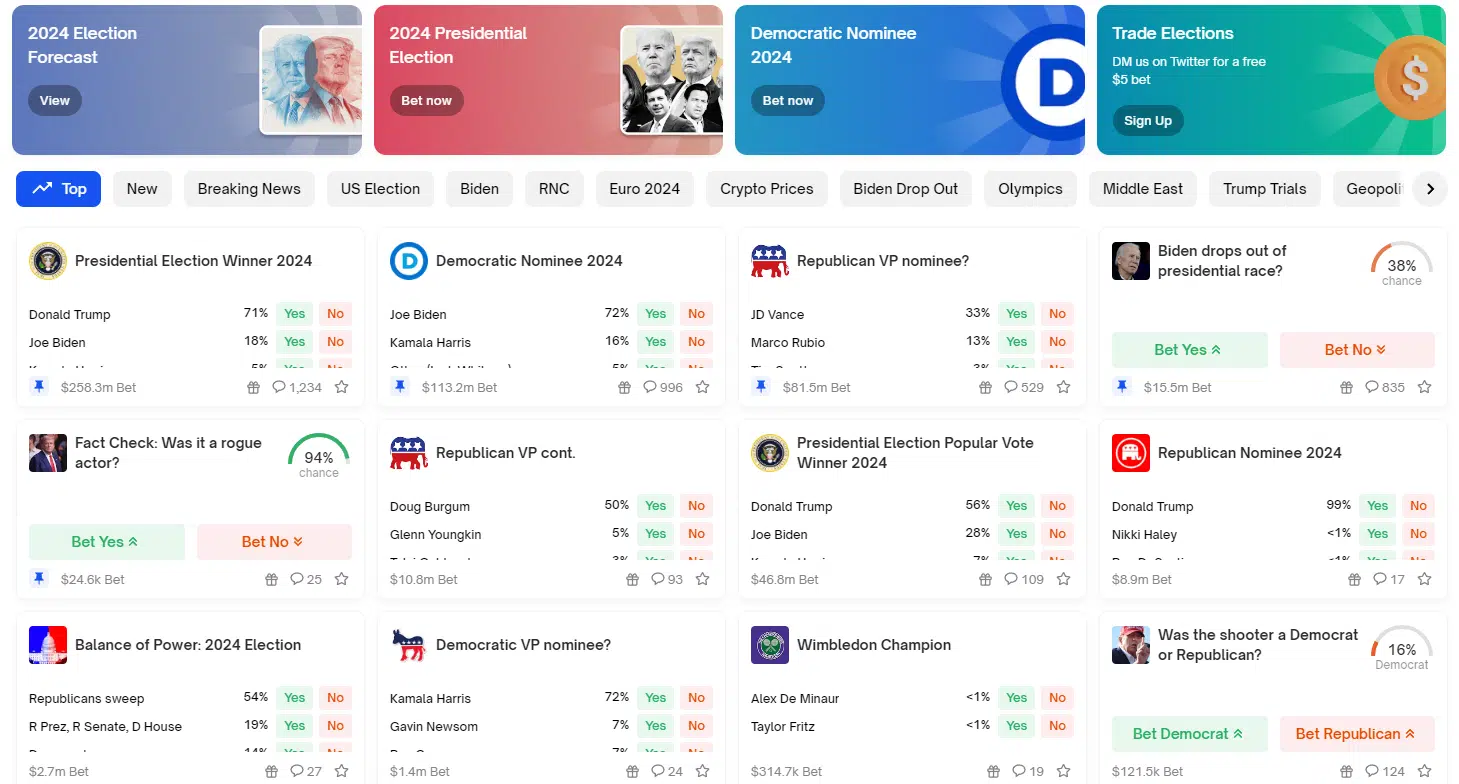

Polymarket is a platform for trading event-based contracts, hosted on the Polygon blockchain and using USDC for transactions. It allows users to speculate on various outcomes, including politics, crypto prices, sports, and global news events.

Unlike traditional gambling, Polymarket emphasizes transparency by using smart contracts to automate payouts and manage trades.

How Does Polymarket Work?

Hybrid decentralized functionality

- Liquidity Pools: Community-provided liquidity facilitates trading, and share prices are determined by market sentiment.

- Centralized Limit Order Book (CLOB): Supports on-chain, non-custodial settlements with off-chain matchmaking for efficiency.

- Event Resolution: Outcomes are determined programmatically through oracles and platform decisions.

While it offers decentralized elements, Polymarket retains centralized control over disputes, market creation, and maintenance, categorizing it as a hybrid-decentralized platform.

Key Features of Polymarket

What sets it apart from traditional betting

- Transparency: Smart contracts provide clarity on payouts and market mechanics, unlike traditional bookmakers.

- Diverse Event Options: Covers politics, crypto, sports, and more, catering to various interests and analytical expertise.

- Swing Trading: Users can trade shares mid-event, profiting from market sentiment shifts without awaiting resolution.

- Lower Entry Barriers: No KYC required; registration only involves a name and email address.

Benefits of Using Polymarket

Why traders are drawn to it

- Enhanced fairness compared to traditional systems.

- Greater insights into market sentiment and crowd-driven predictions.

- Broader event selection, empowering niche analysts.

- Opportunity for swing trading, enabling profit-taking before event resolution.

Risks and Challenges

What to consider before trading

- Liquidity Risks: Low-liquidity markets may cause price slippage, reducing profitability.

- Impermanent Loss: Liquidity providers may lose value due to market fluctuations.

- Platform Security: As with any DeFi service, risks of hacks or exploitation exist.

- Tough Competition: The analytical community makes it challenging for new traders to succeed without a robust strategy.