3 min read

TAKE A BREAK

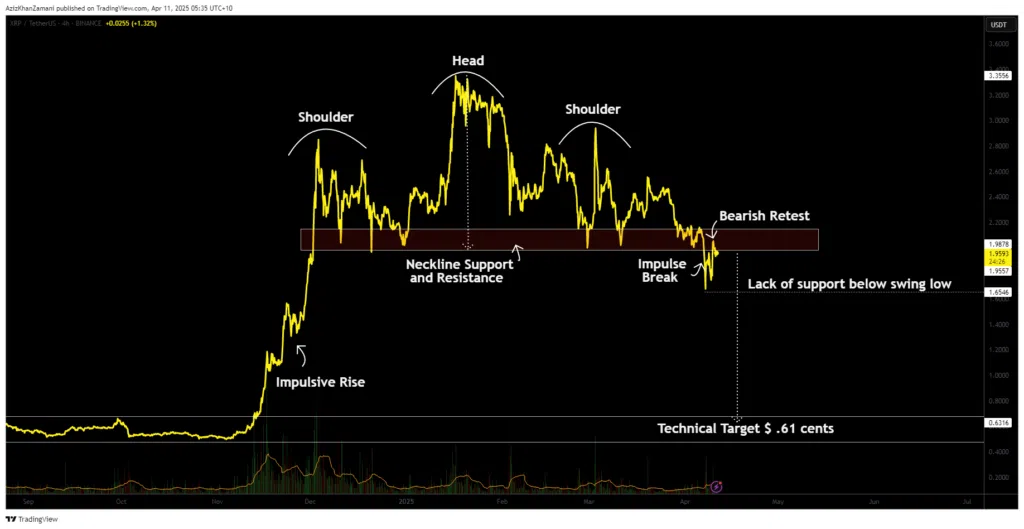

XRP Signals Bearish Breakdown: Could the Price Crash to $0.61?

Updated: 4/11/2025

A Bearish Technical Formation Emerges

The head and shoulders pattern signals potential downside

XRP’s recent price structure is aligning with a textbook head and shoulders pattern, often considered a bearish indicator in technical analysis. The neckline—located between $1.97 and $2.13—has already been breached, suggesting the beginning of a downward phase.

This pattern developed after XRP's rally peaked around $3.37, followed by a slow consolidation period. As the right shoulder formed with a lower high, bearish pressure began mounting. The price’s recent breakdown below the neckline confirms the market’s shifting sentiment.

The Breakdown Point: Key Levels to Watch

Neckline breach and swing low are crucial for confirmation

Currently, XRP is testing the neckline from below, a common retest scenario. If the asset fails to reclaim that support and proceeds to break the swing low, it will confirm the head and shoulders pattern, setting a technical target at $0.61.

This price level is concerning because it sits in a low-support zone, meaning the asset could fall swiftly without significant buyer resistance. The speed and size of the potential drop mirror the impulsive upward move that preceded the pattern.

Market Sentiment and Momentum

Trader confidence weakens as structure deteriorates

XRP had been climbing steadily since late 2024, but this pattern suggests a potential reversal of that trend. Bearish sentiment has returned as traders interpret the neckline break as a shift from accumulation to distribution.

Volume trends also support the bearish thesis, with increasing sell-side pressure during the neckline breakdown. This shift reflects a broader decline in confidence following recent crypto market volatility.

Trade Setup for Bears

A calculated short opportunity with clear entry criteria

Traders eyeing a short position should wait for confirmation via swing low breakdown, which would activate the pattern completely. Once activated, the target becomes the $0.61 level, offering a high reward potential relative to risk.

Caution is key—jumping into the trade prematurely could result in losses if the price manages a fakeout and reclaims the neckline. Only a clean break and close below the swing low gives the green light for the short setup.

The Broader Picture for XRP

What this means for Ripple holders and technical traders

If XRP completes the breakdown, it could set a bearish tone for the token in the coming months. The decline may shake out weak hands and test investor confidence in Ripple’s long-term value.

This scenario also underscores how technical analysis plays a crucial role in crypto markets, where price patterns often unfold with high volatility and limited news catalysts.